Energy Saver Home Loan Program (ESHLP): MA Financing Guide

What is the Energy Saver Home Loan Program (ESHLP)?

The Energy Saver Home Loan Program is a Massachusetts state-backed financing option that allows income-eligible homeowners to fund major energy upgrades, such as heat pumps and insulation, using low-interest loans typically structured as second mortgages.

Here’s a problem we see all the time: A homeowner gets a Mass Save home energy assessment. The energy auditor shows them how much they’d save with heat pumps and better insulation. The numbers make sense. But when the contractor quote comes back at $35,000, the project stalls.

Sound familiar?

The Energy Saver Home Loan Program exists specifically to fix this gap. It’s not perfect, and it won’t work for everyone, but if you’re income-eligible and looking at a major energy upgrade, it’s worth understanding how it actually works.

Table of Contents

ToggleWhat ESHLP Actually Is

The Energy Saver Home Loan Program is a state-backed financing option that lets qualifying Massachusetts homeowners borrow money at below-market rates for energy projects. Most loans are structured as second mortgages, which means lower interest than you’d get with a personal loan or contractor financing.

The basic idea: instead of saving up for years or taking a 12% APR home improvement loan, eligible homeowners can finance the work now at rates that actually make sense.

Who Can Use It?

Three main requirements:

1. You own your home – Primary residence, single-family or 2-4 unit property in Massachusetts

2. Your income qualifies – Generally up to about 135% of Area Median Income. This isn’t poverty-level assistance; a family of four in many parts of the state can earn over $150,000 and still qualify, depending on location.

3. Your project saves energy – Most projects need to show at least a 20% modeled reduction in energy use

The income limits surprise people. This isn’t just for low-income households—plenty of middle-class families qualify.

What Projects Does It Cover?

ESHLP works for whole-home energy improvements. That includes:

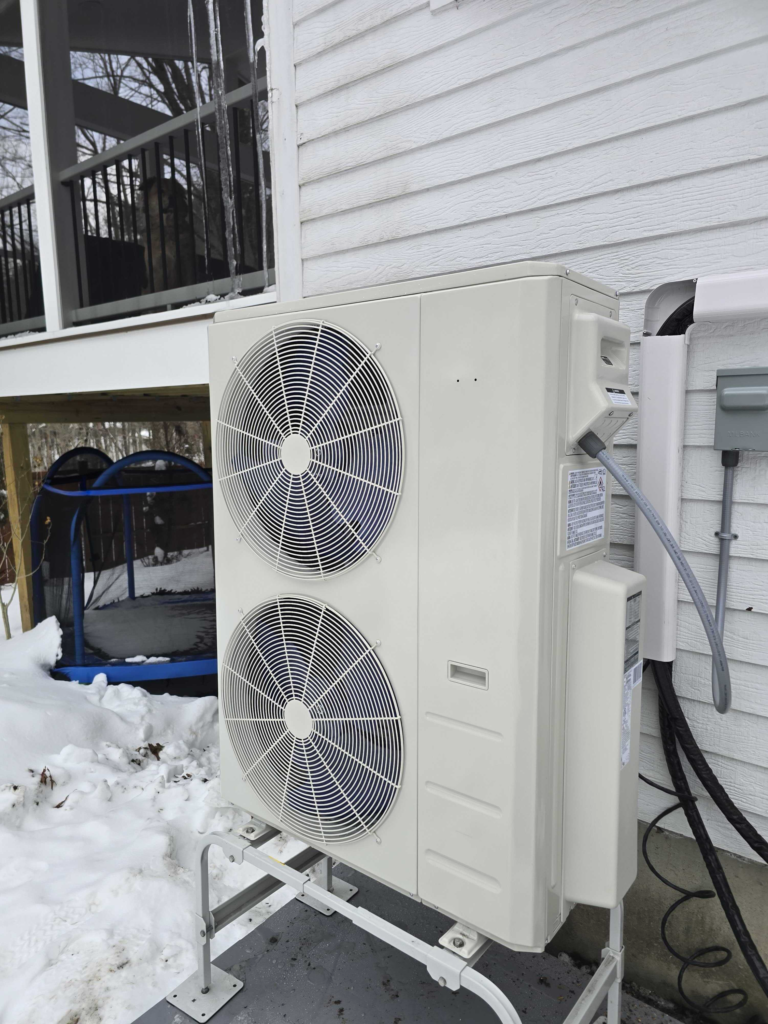

- Heat pumps (air source and ground source)

- Heat pump water heaters

- Insulation and air sealing

- Electrical upgrades (panels, service increases)

- Solar panels and battery storage

- EV chargers

- Oil tank removal

- Even roofing or structural work if it’s necessary to complete the energy upgrades

The 20% energy reduction requirement means you typically can’t just finance a single heat pump for one room. But if you’re doing a comprehensive project—full weatherization, heat pump system, maybe solar—that’s exactly what this program is designed for.

How the Process Actually Works

Here’s the realistic timeline:

Step 1: Talk to a Concierge Service Provider

These are regional organizations that manage ESHLP applications. They verify your income and property eligibility upfront. No point going further if you don’t qualify.

Step 2: Get a Home Energy Assessment

A professional evaluates your home’s current energy use and identifies opportunities. This is where you find out what makes sense for your specific house.

Step 3: Gather Contractor Quotes

You work with approved contractors to build a scope of work that meets the 20% threshold. The Concierge helps coordinate this.

Step 4: Apply for the Loan

Your application goes through a participating lender. The program administrators help with the paperwork.

Step 5: Get Approved and Start Work

Once funded, you can begin installation without waiting months for rebate checks to arrive.

Most people get through this in a few months, though complex projects can take longer.

The Actual Loan Terms

Every situation is different, but typical terms include:

- Loan amounts between $10,000 and $100,000

- Interest rates well below standard home improvement loans

- No cash down required

- Repayment structures that work with construction timelines

The no-money-down aspect matters. A lot of homeowners have equity but not $30,000 sitting in checking.

How This Works With Rebates

This is where ESHLP gets interesting.

Normally, you complete a project, submit paperwork, and wait 3-6 months for rebate checks from Mass Save and your utility. That’s fine if you paid cash, but if you’re financing, you’re paying interest while waiting for money you’re already owed.

With ESHLP, you can:

- Finance the full project cost upfront

- Complete the work immediately

- Apply for eligible heat pump rebates after installation

- Use those to pay down the loan balance

So instead of waiting to start the project until you’ve saved up the net cost after rebates, you start now and let the rebates reduce what you owe later.

Is This Program Worth Using?

ESHLP makes the most sense if you:

- Need to finance a major energy project (small projects don’t need this level of structure)

- Fall within the income guidelines

- Want professional guidance through the rebate and contractor process

- Prefer predictable monthly payments over depleting savings

It’s not the right fit if you can comfortably pay cash, or if your project is too small to justify the loan setup process.

How We Help With ESHLP at Endless Energy

We work with Massachusetts homeowners on heat pump installations, weatherization, and comprehensive energy upgrades. Part of that means helping people understand their financing options, whether that’s ESHLP, Mass Save incentives, utility programs, or combinations of all three.

The financing piece matters because the right project at the wrong time (financially) is still the wrong project.

If you’re trying to figure out whether ESHLP makes sense for your situation, we can walk through your specific numbers and help you see what you’d actually pay monthly versus what you’d save on energy costs.